In Search of Symbiosis: Q&A with Andrew Gorecki

As seen on Power Retail. Power Retail’s Editor, Ally Feiam sat down with Andrew Gorecki, Co-Founder and Managing Director at Retail Directions, to discuss the benefits of finding the equilibrium for retailers, technological headaches and the power of the customer experience.

For many omnichannel companies, the focus is pulled purely into e-commerce. Although e-commerce, marketplaces and Native Apps play a substantial role in the retail industry, it’s important to find a balance between online and brick-and-mortar stores.

When e-commerce was introduced into the mainstream, there were some fears that brick-and-mortar stores would soon become extinct. “I like to point out that in 1910 the media prophesised that by 1920 all brick and mortar retail would be extinct, replaced by mail orders. Such attempts to infinitely extrapolate past statistics into the future invariably produce unreal numbers,” explained Gorecki.

“E-commerce has become an important part of the retail ecosystem, but it won’t conquer 100 per cent of the territory, just as mail order didn’t. Some retailers now realise that heavy investment in e-commerce without optimising their supply chain and other parts of their operations was a somewhat costly mistake. Systems and data uniformity must be achieved across the entire retail enterprise, not just in the e-commerce space. We’ve seen our clients achieve enviable results across all channels, with the simple advantage of the retail-specific architecture in our software platform, rarely achieved by their competitors, yet essential for the 21st century retailing.”

Failing to embrace the Digital Path to Purchase is one of the mistakes that Gorecki sees retailers making, placing too much importance on e-commerce and marketplaces, rather than establishing a symbiotic and harmonised brand across all channels. “This impacts their approach to technology, with a considerable negative impact on their businesses. Disjointed systems will never work well together and claiming that they stemmed from a ‘best of bread’ strategy won’t make the underlying problem go away. Retailers need specialised technology that delivers mission-critical strength – high uptime, speed, consistency, and recovery. Along with a centralised database that unifies the business across channels,” Gorecki said.

Of course, the Australian market differs significantly from its global counterparts, such as Europe. From the size of the country to its tax compliance, it can be hard to draw a comparison between the markets. If something works in Europe or the U.S, it doesn’t necessarily mean it will report the same in Aussie waters.

“The volume of retail space per capita, cost of retail real estate, labour costs and labour regulations still create unique operating environments in each region. Most of these factors continue to be unfavourable for Australian retailers. Tax compliance rules also differ, for example, we had to implement blockchain-type technology so our point of sale can be used in the Portuguese, French and Austrian markets. This ensures the complete integrity of the financial transaction,” said Gorecki.

“Multiple languages and currencies used in European countries also forced us to design a retail platform that can handle such a mix, often running on a single system. Lastly, the majority of European countries enjoy a more compact market than Australia. Their supply chains and catchment areas do not suffer from the same tyranny of distance as much as we do,” he explained.

Technology continues to adapt and grow, which reflect in the online retail landscape. Although many advancements result in becoming fads, there are a few that have the potential to develop into something prominent. “Having been in the retail game for over 35 years I’ve seen a lot of fads come and go. There has never been a technological silver bullet for a retailer without a solid merchandise offer, a bit of kismet (at least at the start), and a proper understanding of retail 101,” explained Gorecki. “We’ve seen talk of AR, VR, AI, Cloud, RFID, you name it. Out of all the hype, I think AI can be most useful in retail, but this won’t happen for as long as AI remains misunderstood. Interpreting AI as Artificial Intelligence makes no sense, as no one on the planet can explain what ‘intelligence’ really means, so how could anyone attempt to create an artificial version of it?”

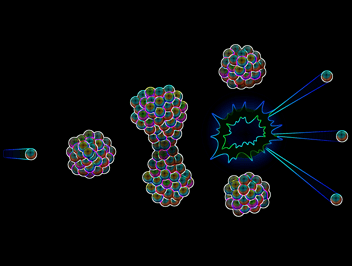

“The first step in embracing AI requires retailers to develop a data hygiene and utilisation culture, then start small with Primitive AI. For example, a retail chain with 1,000 stores and 100,000 SKUs must make 100 million decisions to replenish the stores. This begs to be automated before anything else. The journey towards AI must begin by putting in place smart algorithms: to forecast demand, to identify best sources of stock, estimate customer traffic, maintain a coherent customer database, optimise staff rosters, decide on transport options, etc. Once all the basics have been mastered, machine learning platforms could be brought in, which have potential to automate more complicated human tasks, take actions that humans would not be able to decide upon, and evolve their algorithms as well as efficiency along the way,” Gorecki said.

As retailers find the balance between tech, legacy and staying in the loop, it’s important to not discount the importance of customer experience. “Customer service must be delivered with consistency, as defined by the brand. Insufficient or excessive customer services undermines the brand and it harms the business in the long-term,” explained Gorecki.

Not every brand has to offer exceptional customer service in order to succeed, but the experience must remain consistent and on-brand. “For example, one of the most successful global retailers – Aldi – requires its customers to pack their own bags, offers no packing space (scan to trolley) and it doesn’t provide e-commerce or home delivery – none of that. But, Aldi stays consistent with its low operating costs that allow the business to maintain low price points, the number one reason more and more people choose to shop at the grocer,” Gorecki continued. “Conversely, if a customer walks into Tiffany & Co and doesn’t receive a royal welcome, they will more likely spend their wheelbarrow of money elsewhere.”

As with all online retailers, optimisation of mobile shopping remains an essential factor to pull focus into, along with cementing and securing logistics. “[The] proliferation of mobile phones has reached saturation point (90 per cent phone ownership has been generally accepted as saturation), meaning that pretty much anyone, particularly in the developed world, who could own a mobile device now has one. Since a major catalyst driving the increase in online retailing has been the mobile devices, this saturation puts a limiting factor on the growth of e-commerce,” said Gorecki.

“Next, our logistical delivery networks have also been becoming increasingly saturated, particularly in countries such as the US. Any country’s infrastructure can handle only so many deliveries without the escalation of delivery costs. This will also dampen the growth of e-commerce,” he continued.

“Lastly, the US government has already started to take antitrust actions against the likes of Alphabet (Google), Amazon, and Facebook. We can expect that they will be broken up just like Standard Oil was dismembered back in 1911. The antitrust dissolutions will come in under the auspices of protecting the public interest, however, the size and the power that these technology giants wield has become an increasing, direct threat to government authority.”

As retail continues to transform and metamorphosis, maintaining a healthy and balanced relationship across all channels is a key way to sustain a strong and secure business model.